The Impact of Home Inspections on Insurance Premiums

When it comes to insuring your home, the condition of your property can significantly influence your insurance premiums. Here’s how home inspections can impact your insurance costs and what you need to know to potentially save money on your policy.

Understanding Insurance Premiums

Home insurance premiums are influenced by various factors, including the value of the home, its location, and the risk of certain perils like fire or flooding. Insurance companies assess the risk associated with insuring a property, and a well-maintained home is generally seen as a lower risk, which can lead to lower premiums.

The Role of Home Inspections

Home inspections provide a detailed assessment of a property’s condition, identifying potential issues that could affect its safety and value. For insurance companies, these inspections offer valuable information about the home’s risk profile.

a. Identifying Risks

During a home inspection, problems such as outdated electrical systems, plumbing leaks, or roofing issues are identified. Insurance companies consider these factors when calculating premiums. For example, homes with old wiring or significant water damage may be deemed higher risks, leading to increased insurance costs.

b. Specific Coverage Concerns

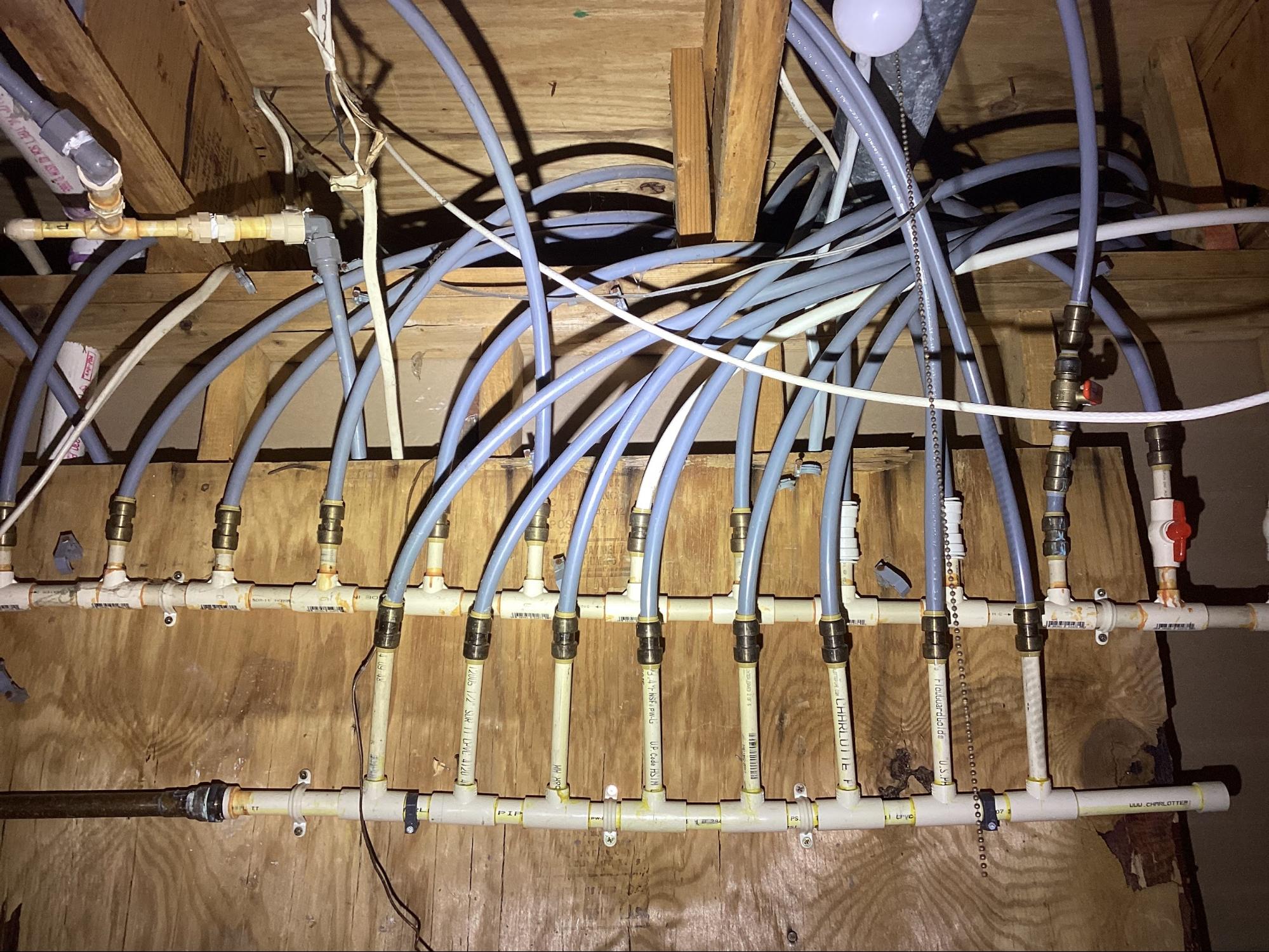

Certain issues can have a direct impact on your insurance coverage. For instance, many insurance companies do not provide coverage for homes with polybutylene pipes, a type of plumbing material known for its susceptibility to leaks and failures. If a home inspection reveals the presence of polybutylene pipes, it may affect your ability to secure a policy or result in higher premiums due to the increased risk.

Benefits of a Pre-Insurance Inspection

a. Avoiding Surprises

By having a pre-insurance inspection, you can address potential issues before they impact your insurance premium. This proactive approach can prevent unexpected costs and ensure you’re not caught off guard by higher premiums due to unresolved problems.

b. Potential Discounts

Some insurance companies offer discounts for homes that are well-maintained and in good condition. A pre-insurance inspection can help you identify areas where you can make improvements to qualify for these discounts, ultimately reducing your insurance costs.

Regular Maintenance and Inspections

Regular home maintenance and periodic inspections can help maintain your home’s condition and, by extension, your insurance premiums. Keeping up with routine tasks like checking for leaks, inspecting the roof, and servicing HVAC systems can help avoid major issues that could affect your insurance costs.

Communicating with Your Insurer

It’s crucial to communicate with your insurance provider about any findings from your home inspection. If you make improvements or repairs based on the inspection report, inform your insurer. They might adjust your premium based on the updated condition of your home. Additionally, being upfront about specific issues like polybutylene pipes can help you understand how to address them and potentially find coverage solutions.

Conclusion

Home inspections play a significant role in determining insurance premiums. By understanding the connection between home inspections and insurance costs, you can take proactive steps to maintain your property’s condition, potentially lower your premiums, and avoid surprises. Regular inspections and maintenance are key to keeping your home in good shape and your insurance premiums manageable.